The Beginning of VSSU Microfinance

VSSU started working in the area of microfinance in 1990. However, after mixed success, the program shut down in 1992.

In 1994, Mr. Mondal was riding in a rickshaw on his way home after working in Kolkata. During this ride, he struck up a conversation with the rickshaw driver and he learned that the man had been paying 5 rupees rent every day for the use of the rickshaw to its owner. It was very difficult for the man to continuously pay this amount in rent and he had no prospect of purchasing a rickshaw himself. Then and there, Kapil asked the driver if instead of paying the 5 rupees daily to the rickshaw owner, the driver would be willing to pay him the 5 rupees daily. However, rather than this process continuing endlessly, when the driver had paid back the full amount of the rickshaw, he would own it free and clear. The driver agreed, and this restarted VSSU’s involvement in microfinance. The organization has not turned back since.

VSSU did rework its microfinance policies slightly in 1996, but this was only to reflect and adapt to the experience VSSU had gained in the last two years of operations. Since then, VSSU has been regarded as a leader in innovative microfinance and extending financial services to those individuals of South 24 Parganas that might otherwise be considered unbankable. VSSU’s microfinance services allow families and individuals to improve their economic situation as well as stabilize what are sometimes otherwise very vulnerable lifestyles.

In addition to providing quality financial services to the individuals of South 24 Parganas, VSSU uses the revenue it generates from its microfinance activities to facilitate other community development projects. These projects range from the operation of schools and programs for children, to livelihood training programs, to feeding programs for the elderly. These will be discussed in more depth in upcoming sections.

.jpg)

The Uniqueness of VSSU’s Microfinance Model

There are several aspects of VSSU’s microfinance services that set it apart from the competitors. The root of these differences is that VSSU employs a savings-based credit system, while other organizations use conventional credit systems. VSSU’s approach to microfinance is much more flexible and tailored to the client’s needs, as opposed to the conventional credit system, which is relatively rigid.

In the conventional credit system, the payback period for a loan is fixed so the company can be assured to receive the maximum interest payments possible, while still recovering the entire principal amount. In VSSU’s model, there is a maximum payback period, but clients can opt to payback early if they are able, so as to lessen the amount of interest they must pay. This flexibility is extremely beneficial for the client, if they have the ability to repay early.

While a certain degree of structure is necessary, conventional credit systems often employ too much rigidity and structure when it comes to granting loans. There are no exceptions for special circumstances that the client may be in, the loan amount may be quite small because of lack of collateral, and these restrictions can get in the way of the clients success. With VSSU’s form of microfinance, the loan amount is determined jointly based on the proposed project or venture that the client wishes to invest in, and with the balance of their savings account and history with VSSU. If the client has a strong idea for how they will use the loan and a decent history with VSSU, they are likely to receive a larger loan with more flexible terms than they would under the conventional credit system. VSSU is quite likely to be mindful of special requests and situations of their clients, while conventional credit institutions will strictly follow their regulations.

Under VSSU’s savings-based microfinance model, savings clearly plays a major role. Savings is encouraged as a way to increase household stability, but it also serves as an important indicator to VSSU about how reliable a client is. Clients are encouraged to save a minimum amount regularly, but they are able to deposit more than their minimum if they have extra funds. Under conventional credit systems, clients are limited in their savings ability by their contracts, which is not in the best interest of the client. Additionally, in VSSU’s model, the institutional risk for lending is much lower because clients also save with VSSU. This means that a client is less likely to default on their loan because they know that VSSU will then seize their savings.

When VSSU invests in clients by providing them loans, they are showing a great deal of confidence in the ability and principles of their clients. Because VSSU often gives exceptions when granting loans, allows clients to take larger loans than another institution might, and provides flexibility in repayment options, their clients understand that they are trusted, and this can have positive impacts on the confidence and strength of the client. Conventional credit systems are primarily interested in generating income for the company, and they are not concerned with fostering multi-faceted growth on the part of their clients, as is possible through VSSU’s method.

What is truly unique about VSSU’s model of microfinance, however, is what they do with the funds they generate through their microfinance activities. Conventional credit institutions take their revenues and reinvest to make their company bigger, or they use the profits for personal purposes. VSSU, however, uses the revenues from its microfinance activities to reinvest in social and community development initiatives. Over the years, VSSU has used the revenues from its microfinance activities to start schools, programs for children and the elderly, an eco-tourism project, a library, and more. This shows an immense and pure commitment to the community, without any personal greed interfering in the operations of the organization.

The following is an example of how the conventional credit system and VSSU’s credit system differ:

A poor man seeks a loan in the conventional credit market. He receives a loan for Rs. 10,000. Each week, he is required to pay Rs. 250 until the loan is paid off. Once he has paid in full, the man is left with no other support from the credit institution.

Now consider the same poor man who seeks a loan through VSSU. To receive the same Rs. 10,000 loan he must deposit Rs. 1,000, or 10% of the total amount to be disbursed. This security deposit increases the stake that the man has in his loan and increases his level of personal responsibility. To repay his loan, the man pays only Rs. 200 per month at a reducing rate of interest. He also has flexibility in his repayment; for example, if he is a farmer, he may begin to repay after the harvest when he has the additional income. This flexibility is possible because of the 10% security deposit he gave before the disbursal of the loan.

While the VSSU model may seem somewhat more complex and nuanced than that of the conventional credit institution, it is designed to better serve the clients and ensure not only successful repayment, but also the long-term wellbeing and success of the clients.

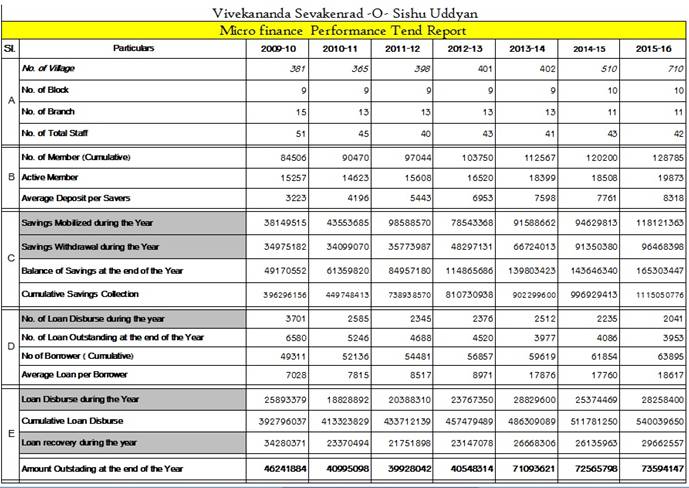

VSSU Microfinance Performance Trends

The following is a quick glance at the trends in VSSU’s microfinance activities from 2005-2012.